Initially planned for July, the administration has expedited this provision of the program to accelerate relief to borrowers almost six months ahead of schedule, according to a statement from the White House. The Biden administration says that it has approved nearly $138 billion in debt relief for 3.9 million Americans through dozens of executive actions. Those who are eligible for the latest round of relief have been enrolled in repayment plans for at least 10 years and originally borrowed $12,000 or less for college. Several groups of borrowers have been targeted for debt relief, including those who:The Biden administration has announced it will be cancelling $1.2 billion in student loan debt for nearly 153,000 borrowers currently enrolled in the Saving on a Valuable Education (WAVE) repayment plan.

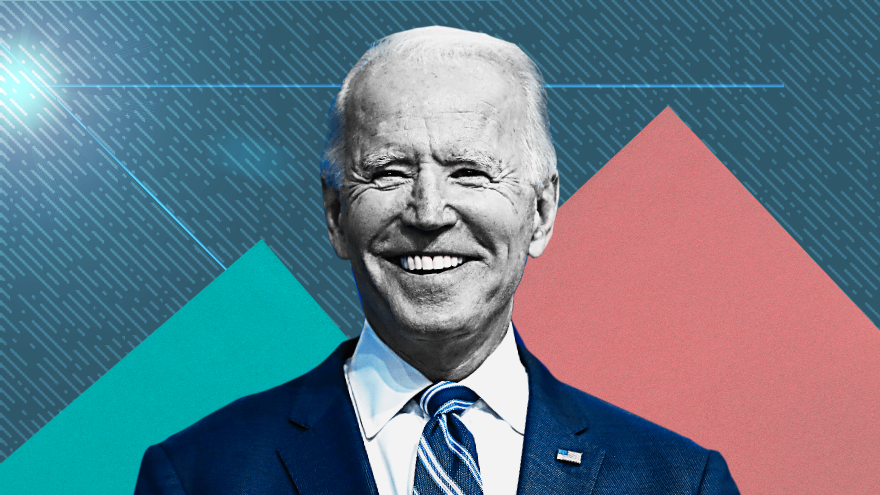

Borrowers impacted by the debt cancellation program will receive an e-mail from President Joe Biden on Feb. 21 informing them of their financial relief. There is no action borrowers need to take regarding their loans. “Congratulations — all or a portion of your federal student loans will be forgiven because you qualify for early loan forgiveness under my Administration's SAVE Plan,” Biden writes in the email. “From day one of my administration, I vowed to fix student loan programs so higher education can be a ticket to the middle class — not a barrier to opportunity,” the message continues. “Part of that commitment was developing the most affordable student loan repayment plan ever — the SAVE Plan. Because you signed up for and fulfilled the repayment requirements under my Administration's plan, your eligible federal student loans will be forgiven. You will receive an email from your loan servicer notifying you that your debt has been forgiven.” Last June, the U.S. Supreme Court struck down the Biden administration’s student loan forgiveness plan, stating that the executive branch had overstepped its authority. After the Court rejected Biden’s first attempt at student loan cancellation, he vowed to continue exploring other ways to meet this objective. “Today’s decision has closed one path,” Biden said after the ruling, adding that he had directed his education secretary to examine a different law by which his administration could forgive debt. “Now we’re going to pursue another.” While the previous attempt at loan cancellation was done via executive order, this time around the Biden administration has turned to the rulemaking process as an “alternative path to student debt relief,” the Education Department said in a statement. “With today’s announcement, we are once again sending a clear message to borrowers who had low balances: if you’ve been paying for a decade, you’ve done your part, and you deserve relief,” U.S. Secretary of Education Miguel Cardona said in the statement. “Under President Biden’s leadership, our Administration has now approved loan forgiveness for nearly 3.9 million borrowers, and our historic fight to cancel student debt isn’t over yet.” The Department of Education also says that the administration has approved: