The Federal Communications Commission (FCC) has narrowly approved a nonprofit funded by billionaire George Soros to take control of over 200 radio stations.

The stations had previously belonged to radio broadcaster Audacy Inc., which filed for Chapter 11 bankruptcy earlier this year.

After a restructuring was approved in court in February, the FCC has cleared the way for Soros’ Fund for Policy Reform to take over the stations, which will be governed by a board of four people, including the billionaire’s son, Alexander Soros.

“We approve the assignment of licenses held by Audacy, which has been under the control of a bankruptcy court, to the new Audacy, so that the company can emerge from bankruptcy proceedings,” wrote FCC Chairwoman Jessica Rosenworcel in a Monday filing. “Our practice here and in these prior cases is designed to facilitate the prompt and orderly emergence from bankruptcy of a company that is a licensee under the Communications Act.”

Bloomberg reports Audacy’s return from bankruptcy could be expected in the next few days, the company said.

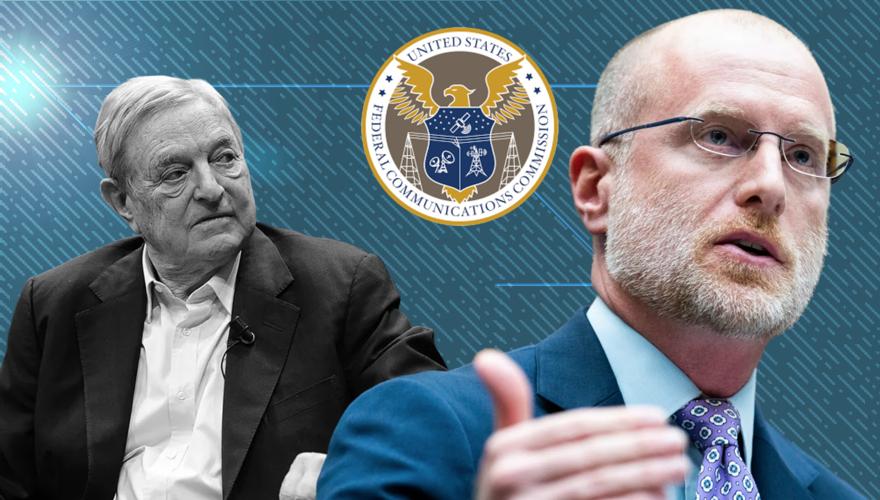

Two of the five FCC commissioners, Brendan Carr and Nathan Simington, opposed transferring the licenses.

“The Commission’s decision today is unprecedented,” Carr wrote on X. “Never before has the Commission voted to approve the transfer of a broadcast license—let alone the transfer of broadcast licenses for over 200 radio stations across more than 40 markets—without following the requirements and procedures codified in federal law. Not once.”

In his dissenting statement, Carr claimed the approval violated Section 310(b) of the Communications Act, which limits foreign ownership in broadcast licenses to 25 percent.

Carr said the applicants “expressly state in their filings that they will have foreign investment in excess of [the] 25 percent benchmark.”

The dissenting commissioner detailed various other ways in which legal procedures were bypassed without proper rule changes and public input.

“The Commission has never done this before. So why are we voting for a first-ever fast track today?” he added. NEW

The FCC just released the text of its 3-2 decision to approve a Soros backed group’s purchase of 200+ radio stations.

The Commission’s decision today is unprecedented. Never before has the Commission voted to approve the transfer of a broadcast license—let alone the… pic.twitter.com/gnMbl2z8Jb

— Brendan Carr (@BrendanCarrFCC) September 30, 2024

Simington had similar objections:I just have to point out: a Commission eager to fast-track a billion dollar broadcast media reorganization, disregarding foreign ownership concerns, is the same Commission that has gone back to the well several times to impose and re-impose foreign sponsorship identification rules on our smallest independent broadcast license holders every time they place local church content on the air. Just saying.

In a Sept. 26 letter to Rosenworcel, Rep. James Comer (R-Ky.), who chairs the Committee on Oversight and Accountability, raised concerns over the FCC majority politicizing the agency.

“Despite the unprecedented nature of this action, the FCC majority has apparently decided to approve licenses on an accelerated timeframe for a company in which George Soros has a major ownership stake, and with stations in 40 media markets reaching ‘more than 165 million Americans,’” he wrote, citing a Sept. 24 report from Fox News.

Comer added: “By all appearances, the FCC majority isn’t just expediting, but is bypassing an established process to do a favor for George Soros and facilitate his influence over hundreds of radio stations before the November election.”

According to the FCC filing, Audacy will reduce its debt by $1.6 billion to $350 million.

CEO David J. Field will retain his current position and serve on the company’s board.

“We’re big believers in audio, and we’re very well positioned to exceed and excel going forward,” Field said in an interview Monday with Bloomberg. “We’ve continued to really enhance our ad tech, data capabilities, and content and have emerged as a much stronger company than we were a year or two ago.”

He added: “We now have the industry’s strongest balance sheet.”